Absolute Return: The total gain or loss of an investment over a defined time period.

Alpha: A measure of investment performance vs a market index or benchmark.

Alternatives/Alts: This is an asset class that differs from the equity and fixed income classes, and is a term typically used to describe other assets. These can include commodities, real estate, private equity.

Annualised Performance/Annualised Returns: The average return of the fund each year, expressed as a percentage, over a defined time period.

Authorised Corporate Director (ACD): Act as Authorised Fund Manager (AFM) to make sure the fund is in compliance with the rules and regulations of the FCA; for fund protection and fair treatment of investors.

Assets: Described as any financial instrument that has value. Funds and clients invest in assets in the hope of achieving positive returns, and growing their initial amount. (There are risks associated with investing in assets).

Asset Allocation: The internal division of an investment fund, or portfolio by asset class (bonds, equities, commodities, cash etc.) or geographic region, to diversify investment risks.

Asset Class: The type of asset your money is invested in, for example, equities, bonds. Every asset has its own individual characteristics and by investing in various types - or combinations of types - the fund is diversified for its returns and its risk.

Assets Under Management: The value of the entity’s (fund, company, manager) entire investments under its management.

Benchmark/Comparator Benchmark: A comparator against which investment performance is measured, normally a market-based index or the average performance of similar assets or peers. Beating the benchmark is known as outperformance or alpha.

Beta: A measurement of an investment’s volatility against the wider market. The market has a beta of 1.0 by definition, and a fund/stock with a higher beta moves more than the market, meaning it has a higher volatility, and one with a lower beta moves less than the market, making it less volatile.

Bond (A Fixed Income Investment): Essentially an ‘I.O.U’ issued to an investor in return for the loan of their investment capital over a predetermined period of time. They are offered by organisations such as governments, companies or local authorities as a way of raising funds without issuing extra shares. Bonds usually promise to pay a fixed amount of interest, known as the coupon, on set dates.

Capital Gain: The amount by which an asset increases in value over the initial purchase price. A gain is realised when the investment is sold. This action can incur Capital Gains Tax.

Capital Gains Tax (CGT): CGT is a tax on any profits made when an investor sells an asset that is not held in a tax-exempt vehicle, such as an ISA.

Collective Investment: Term used to describe unit trusts, investment trusts, and open-ended investment company (OEIC/ICVC) funds. These are funds where investor capital is pooled to increase individual buying power and to help spread risk through diversification.

Coupon: The amount of interest regularly paid by a bond, usually per £100 nominal of stock.

Cumulative Performance: This is the total gain or loss of an investment over a specific time period, often expressed as a percentage.

Currency Risk: Underlying instruments may be denominated in currencies different to the base currency of the collective vehicle. This causes the risk that the value of the vehicle is affected, favourably or unfavourably, by fluctuations in the relevant exchange rates.

Deflation: An economic term referring to a decline in price of goods and services.

Derivatives: Financial instruments that derive their value from an underlying asset, such as an equity, a bond or a commodity. Derivatives can serve different purposes in an investment, for example they can be used to hedge/protect against certain risks, or getting exposure to an asset without owning it. Derivatives may be used in the fund to create equity exposure when cash balances require it.

Derivatives Risk: The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying asset and whilst these are used to hedge risk, the use of these instruments does not eliminate fluctuations or prevent losses. The increased exposure to an underlying asset could result in greater fluctuations of the Fund’s Net Asset Value.

Developed Markets: Countries with highly advanced economies and stable, sophisticated financial markets, such as the United States of America, or the United Kingdom.

Diversification: The action of using a variety of investments to reduce risk. If a portfolio only owns one particular asset, if a localised event, or market shift affects that asset, then all the money invested is exposed.

Dividend: The income from a share-based investment. Many companies will pay dividends from their profits twice a year.

Dividend Yield: A company’s total annual dividend payment per share is divided by the price per share. The resulting value is often expressed as a percentage or ‘dividend yield’.

Duration: The sensitivity of the price of a bond to changes in interest rates. A bond with a longer duration will typically be more sensitive to changes in interest rates.

Emerging Markets: Countries that have fast-growing economies but are less advanced than their developed peers. These economies may be going through some kind of industrialisation or seismic economic shifts, such as China, or Brazil.

ESG (Environmental, Social & Governance): This is an investment strategy that can incorporate an evaluation of how companies/funds impact the environment, society and corporate management. Governance factors include remuneration, board structure and corporate strategy. Regulators across the globe have differing standards and disclosure requirements for these types of strategies.

Equity: In relation to an investment like a fund, equity is an asset class, normally the common stock/share of a corporation. Equity itself is a broad asset class, with variations in it.

Financial Conduct Authority (FCA): The regulator for conduct of the financial services industry in the United Kingdom. It aims to protect consumers, ensure the financial industry remains stable and promotes healthy competition between financial service providers.

Fixed Income: A type of investment that provides a fixed or predictable return in the form of regular interest payments and a capital repayment over a fixed term.

Gilt: Gilt refers to gilt-edged stocks or bonds that are issued by the UK Government.

Index/Indices: An index is a collection of securities used to track a particular market. Indices as they track the performance of a group of investments, they are often used as a yardstick for performance of a fund.

Index Tracker: A type of fund that aims to replicate the performance of a particular stock market index by buying all or a representative portion of the stocks within that index.

Inflation: Inflation is when the prices of goods and services rise, over time. This means that the current value of your money is eroded and you can’t buy as many things for the same amount of money as before. Inflation is caused by various factors, including amount of money in circulation, changes in consumer demand. Inflation is measured using a price index which tracks the prices of a basket of goods and services.

ISA (Individual Savings Account): A scheme that allows eligible individuals to hold investments and cash tax efficiently.

Illiquid: A description of an investment which is difficult to trade in the market. It can’t be sold/turned into cash easily.

Investor Profile: The type of investor for which a particular investment product is suitable.

Liquidity: This is the ease with which an asset can be sold without a significant loss of value.

Multi-Asset Fund (MAF): An investment fund that holds a mix of different asset classes - such as equities, bonds and potentially cash and alternatives, all within one portfolio, managed by a fund manager.

Model Portfolio Service (MPS): A discretionary investment service where an investment manager runs a set of model portfolios, usually based on different risk tolerances, made up of different underlying funds. Investors hold the underlying assets directly, but the model is centrally managed.

Non-UCITS Retail Scheme (NURS): NURS funds are considered more complex than UCITS funds because they may invest in assets that are harder to price, or may be more illiquid than UCITS compliant funds. NURS products can concentrate investments more in particular assets, or types of assets and can offer greater asset flexibility and a wider range of asset classes. (See UCITS).

Open Ended Investment Company (OEIC)/(Investment Company with variable Capital (ICVC): A collective investment that pools investor capital for increased buying power. The fund is divided into shares which are created and redeemed depending on investor demand (referred to as ‘open-ended’). One of the main differences between OEICs and Unit Trusts is that OEICs quote a single price rather than a bid-offer price.

Performance: There are different ways to interpret performance, but effectively this is how well or badly the investments have done over a specified time period.

Platform: A digital tool that allows investors access to different products, and a tool for IFAs (Independent Financial Advisers) to manage client investments.

Portfolio: A collection of Investments

Real Estate Investment Trusts (REITS): A type of investment fund that owns property.

Rebalancing: The process of re-aligning an investment portfolio to its set investment parameters, risk profile or asset class weightings.

Recession: Technically, a recession is declared after two consecutive quarters of negative Gross Domestic Product (GDP) growth. It is generally used to refer to sustained and slowing/reversal of economic growth.

Share Class: A specific type of share that is issued. Share Classes can have different characteristics, including voting rights, dividend payments, minimum investments and costs.

Synthetic Risk & Reward Indicator (SRRI): Used to indicate the level of risk of a UCITS fund by providing a number from 1 to 7. The intention of the Indicator is to make understanding the risk and reward of a fund simple and digestible. It is based on the annualised standard deviation of total returns over ~5 years. For new funds a proxy/representative data source is used.

Undertaking for the Collective Investment of Transferable Securities (UCITS) Regulation: A UK and EU (split since Brexit) framework that regulates investment funds to provide more investor protection, mandatory liquidity, and create a harmonised market across borders. It comes with particular rules, For example: a fund can invest no more than 5% in a particular issuer.

Volatility: This is how much and how quickly prices move over a given period of time. In Theory, volatility can be seen as risk because it gives a quantitative assessment of the uncertainty of the future of the investment/fund. Volatility is only one measure of risk.

Yield: The annual dividend or income on an investment expressed as a percentage of the price.

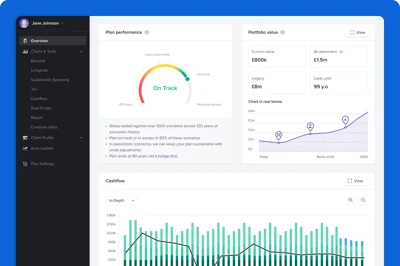

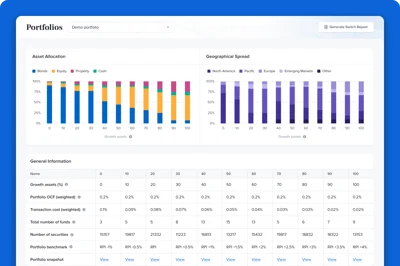

We make financial planning easier for advisers and more engaging for clients. Financial Advisers add the most value to clients through personalised plans and coaching that gives clients clarity and confidence in their financial future. Hear the direct feedback from advisers and firms who have reaped the benefits of working with us.

We make financial planning easier for advisers and more engaging for clients. Financial Advisers add the most value to clients through personalised plans and coaching that gives clients clarity and confidence in their financial future. Hear the direct feedback from advisers and firms who have reaped the benefits of working with us.